Tax season can feel overwhelming, especially for business owners and individuals with intricate financial situations. To help you stay organized and informed, we’ve created this central hub—a one-stop resource to make your tax filing as seamless and efficient as possible.

What You’ll Find Here:

- Important Deadlines

- Common Questions Answered

- How-To Videos

- Direct Contact Information

Getting Started: Look Out for your Tax Organizer

Individual tax clients (1040), you can expect to receive your tax organizer via email during the second week of January from noreply@safesend.com. Please check your junk or spam folder, as it may be filtered there. If you haven’t received it by 1/20/2025, contact cpas@pncpa.biz, and we’ll re-initiate delivery for you. Business clients (1065, 1120 filers etc.), please review the year-end information checklist distributed by our office to get started.

While waiting for your organizer, now is a great time to gather your documents. Submitting everything at once helps us prepare your return quickly and efficiently.

What to Do Once You Receive It

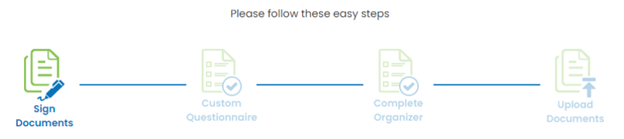

Follow the secure link in the email to access your questionnaire, organizer and upload tax documents. We recommend you complete information and upload documents in one sitting.

- Complete Your Questionnaire & Organizer: Please verify your information and make any necessary updates. If you don’t have all your information handy, you can save your progress and return to it later by selecting “Save & Close” on the questionnaire or “Save & Continue Later” on the organizer.

![]()

![]()

- Documents Upload: After completing your questionnaire and organizer use the upload document feature in SafeSend to send us all supporting tax documents. We prefer PDF files of your tax documents, but can also accept JPEG, Word, and Excel files. If you attach a JPEG photo image, make sure it is legible. Your tax preparer cannot begin without receiving supporting documents. To submit your documents, click “Finish”. Once you click Finish, you cannot upload additional documents without contacting our office.

![]()

Important Deadlines

- Individual tax clients (1040), in order to guarantee timely completion and submission by April 15th, clients must submit all information and supporting documents by Monday, March 17th.

- Business clients please be aware of the March 17th (s-corps, partnerships, some LLCs) or April 15th (c-corps, sole proprietors, some LLCs) deadline depending on your entity type and fiscal year.

FAQs

To make your tax preparation as easy as possible, we’ve compiled answers to some frequently asked questions.

I need help! Who should I contact?

For assistance, you can email us at cpas@pncpa.biz or reach out to either of our office locations by phone.

Sandusky: 419-625-4942

Norwalk: 419-668-2552

How long should my return take?

Timelines depend on when your information is submitted and the complexity of your return. To ensure timely filing, all necessary documents must be submitted by March 17. However, we encourage early submissions to help us address questions and meet deadlines efficiently.

How do I send my information to Payne Nickles?

The preferred method for submitting documents is through the SafeSend portal. If you’ve already completed your organizer and need the portal reopened, please contact our office for assistance.

I am missing some information. What should I do?

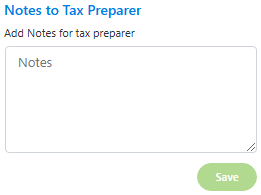

If you’re missing information while completing your organizer and uploading documents, please save and return later. If you need to leave a note for your tax preparer, you can do so directly within the organizer. This feature is only available in the organizer and not in the questionnaire or document upload sections. It is viewed while preparing your return and should not be considered an area to submit time-sensitive questions.

I’d like to complete a paper organizer. What do I do?

Please open your electronic organizer as instructed above. You can download the questionnaire and organizer in the upper right-hand corner to print, complete and return to our office with your supporting documents. Please be sure to download both the questionnaire and organizer.

How will I receive my tax return?

Similar to your tax organizer, Payne Nickles’ preferred delivery method is SafeSend Returns to securely electronically deliver your tax return for signature and consent to e-file (Form 8879). Again, please be on the lookout for an email from Payne Nickles & Company at noreply@safesendreturns.com as the tax deadline approaches. This platform can also be used for making and setting payment reminders.

Ready to pay your taxes online? Follow these instructions:

Federal Online Payment Instructions

Home

Home Sign In

Sign In Make a Payment

Make a Payment Search

Search