In July of 2015, Congress passed and President Obama signed a Highway Funding Bill that extended financing for transportation infrastructure. Section 2006 of that bill modifies the tax filing due dates for tax years beginning after December 31, 2015. The filing deadlines for a variety of entities, including partnerships and C corporations, will change.

The revised filing deadlines are a long time coming for the AICPA, who has been advocating for years for more logical due dates. The current structure makes it is difficult for taxpayers and preparers to submit timely, accurate returns. With the help of state CPA societies, the AICPA lobbied congress to:

- address the complaints from taxpayers and professionals,

- improve the overall tax return filing process through a logical flow of information,

- reduce the reliance on extensions by encouraging earlier filing, and

- ease the administrative burden for the government, taxpayers and practitioners.

So What the new filing deadlines mean for business owners

As a business owner and taxpayer, it is important to be aware of the new filing deadlines to make sure you are submitting timely information. The following two questions will determine your due date:

- What entity is your business considered?

- When is your tax year end date?

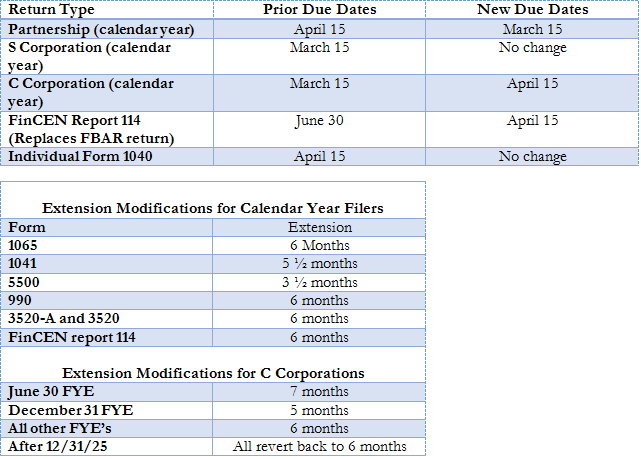

The new due dates are effective for tax years beginning after December 31, 2015 with the exception of C Corporations with fiscal years ending on June 30. New date rules for C Corporations will go into effect for returns with taxable years beginning after December 31, 2025.

We have highlighted below some of the major changes.

Will individual tax filers be affected by the new due dates?

Yes, those who file foreign bank account reports will notice a change. The due date for FBARs will move from June 30 to April 15. FBAR filers are also applicable to receive a six-month extension, similar to tax returns.

Trust Returns

The extension dates for trust returns are receiving an extension. Trust returns are still due in April, but the extension will change from September 15 to September 30.

You will want to review your return-filing procedures and determine what changes need to be made to comply with the new dates. The professionals in our office can help you understand how this will affect your business; call on us today.

419-625-4942

Sandusky

419-668-2552

Norwalk

Treasury Circular 230 Disclosure

Unless expressly stated otherwise, any federal tax advice contained in this communication is not intended or written to be used, and cannot be used or relied upon, for the purpose of avoiding penalties under the Internal Revenue Code, or for promoting, marketing, or recommending any transaction or matter addressed herein.

Home

Home Sign In

Sign In Make a Payment

Make a Payment Search

Search